In the first lesson, we talked about how you should always be paying yourself first. If you haven’t read that yet, please go read it before you read this lesson — otherwise, some things may not make any sense.

Putting away at least 10% of everything you earn is really your first investment, because you’re investing in your future self. Maybe that sounds corny, but it’s true.

Why Should You Save, Anyway?

I didn’t want to assume that you would just automatically agree with the assumption that you should save your money. So I want to give you a few reasons.

You Want Something Expensive

The most obvious reason for saving is that you want something that you can’t afford right now. Sure, you could throw it on a credit card, but you might end up paying interest on it — which means you’ll pay a lot more than the actual cost of the thing you bought. It’s smarter and cheaper to save up your money over time until you have enough to buy it.

You Might Lose Your Source of Income

We talked about this in the first lesson. If you lose your job one day, you’re going to have to figure out how to pay the bills while you look for something new. If you have at least 3 months’ worth of living expenses saved up, it might still suck but at least it won’t be as stressful.

Or, consider that if you have a significant amount of savings to fall back on, you don’t have to stay in a job you hate. Some people call it F*** You Money. Alternatively, instead of saying f*** you and quitting the job, maybe the mere idea that any day you could just walk away would be enough to put up with some of the things you don’t like about your job.

I’ve certainly done jobs where it was hard to work up the strength every day to go in. But in those times when we had a bit of a cushion, it was easier to hang on a little longer.

Spoiler Alert: You are going to be old one day

It doesn’t seem like it now because you’re young and healthy, but one day you’ll be old and maybe not as healthy (but I hope you are). When that happens, it might be harder to work or to find work. Maybe it will be fine, but you still need to prepare for that possibility.

So those are some solid reasons for saving money, but how do you do it? If you’re paying yourself first, then you’re already on your way. Even if it’s only a little bit at a time, you’re still saving. Congratulate yourself for doing that much. The earlier you start, the better. Today is good.

Let’s talk about where to keep your savings.

Making Money Out of Money

Remember how we talked about how banks make money by charging you interest on your debt? The cool thing is that you can do that, too. I don’t mean that you should become a loan shark or something. I mean that you can use banks the same way they use you.

Interest-bearing Accounts

These days there are a few banks that will actually pay you to keep your money with them. As I write this (July 2023), one of our banks pays us almost 5% APY on our savings accounts. That’s a lot, considering that another one of our banks only pays .2%. ← That’s not a typo. It’s decimal 2%, not a whole 2%.

APY means Annual Percentage Yield. It works like this: every month, you earn a certain amount of interest on your money. Over the course of a year, it builds, or compounds. At the end of the year the bank pays you a percentage, not only on the original amount you put in, but they include all the compound interest you earned every month. This is a beautiful thing. You are earning money from your money, just like the banks do.

Hot Tip: Avoid paying bank fees! Whatever you can do to avoid paying fees for a checking or savings account, do it. A lot of banks don’t charge them at all, so go to them first.

Let’s say you put $1,000 into a savings account that pays 5% APY. The monthly interest is 4%. In the first month you earn $40. You now have $1,040. Next month, you earn $41.60 because you get 4% of your new balance of $1,040. This happens every month, so after one year you will have earned $601 without doing anything at all. Obviously, if you put more in savings during that year, you’ll earn more. You’ll also receive your 5% APY, which will be $80. If you earned 5% of the original $1,000, it would only have been $50.

Do you see how this works? If not, go over the math example slowly and try it yourself. To calculate 5% of a number, you multiply it by .05. So:

1601 x .05 = 80

Aside from the math, can you understand what’s happening? You’re earning money without doing anything at all. You didn’t have to work for it again, you just invested it.

This is one way people get wealthy. Making millions of dollars in big chunks as a movie star, athlete, Wall Street broker, or by winning the lottery is great, but only a small minority of people get rich that way. And some of them lose it just as fast. But the cool thing is that you don’t have to be any of those things or win the lottery to become wealthy. You just need to save money and make it work for you. And you can start doing it now.

Wait! Before you stop reading because you think there’s no way you can save money, go back and read the first lesson about paying yourself first.

CDs and Money Market Accounts

There are two other types of interest-bearing accounts that often give you even higher interest rates than a savings account.

CDs

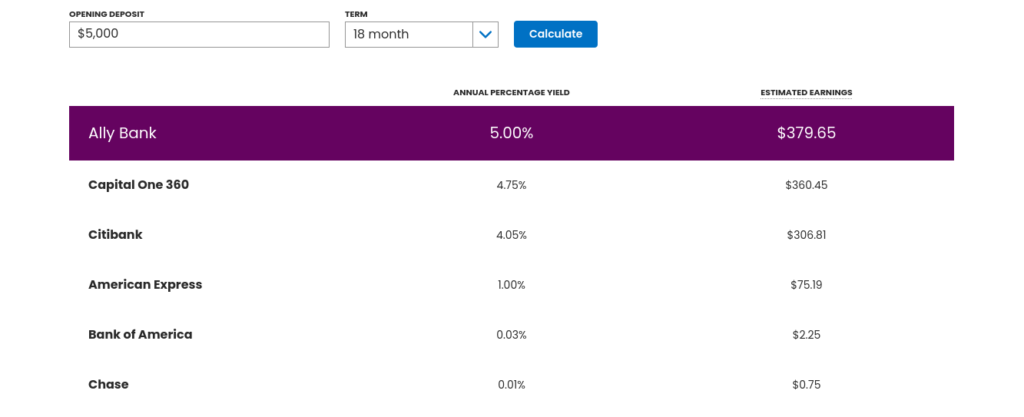

A Certificate of Deposit (CD) is a sort of savings account, but you can’t take your money out for a certain period of time without paying a penalty. You buy a CD for 3 months, 6 months, 12 months, 18 months, or usually 3 or 5 years. The different lengths of time offer different interest rates — it depends on the bank and the market at the time. Right now, Ally Bank is offering 5% interest on an 18-month CD.

Some banks have minimum deposits to open a CD account, and it varies. A CD can be a good idea if you have a big chunk of money and you won’t need to use it for the time period. If you think you’ll need it before the CD matures, then a savings account or money market is better.

Money Market

A money market account is like a savings or checking account. You get an ATM card and checks, and you can take your money out more easily. You get a better interest rate than a regular savings account, and the interest is compounded daily instead of monthly.

The Stock Market

The interest-bearing accounts are the safest ways to save and invest your money. As long as you choose a bank that’s FDIC insured (most are), your money is protected by the Federal government. That means that if something happens to the bank, you’ll still get your money.

I mention this because as we talk about the stock market, you need to understand that you could lose your money. Nobody is protecting it, and if a company you invest in goes under, you could lose it. That’s what happened in the Crash of 1929 that sank the U.S. into the Great Depression — and incidentally why we have FDIC-insured banks now. But there’s a way to invest in the stock market that’s at least somewhat safer. I’ll explain both strategies.

First, some quick basics on what the stock market is if you don’t already know. Companies sell stock in their companies, also called shares. It literally means that when you invest in a company, you share in their profits and losses. When you buy shares, you are a shareholder. Depending on how many shares you have, you also have a say in decisions about how the company operates. If you own shares that make up 25% of the total shares offered by the company, you have a much bigger say than someone who has less than 1% of shares. But voting at a stockholder meeting isn’t what we’re interested in here, we’re talking about making money.

Depending on how well the company is doing and how well the market itself is doing, the price of shares goes up and down several times per day. For example, let’s look at Tesla (TSLA).

In 2019, Tesla stock was trading on average of about $14 per share. Today, the share price is $219. That means that if you bought 100 shares of Tesla in 2019 it would have cost you $1,400. If you held onto it, it would now be worth $21,900.

That’s a much bigger jump than an interest-bearing checking account, right? The downside is that the stock could also go down just as sharply. For example, Intel stock was trading at $45 per share in July of 2022. That October, it dropped to $25 per share. Oops. It’s been slowly climbing since then, but it’s still not back up to $45 and it may never go that high again. That’s the risk you take, and that leads us to our first stock market strategy, day trading.

Day Trading

If the thought of gaining thousands of dollars by lunch and then losing even more by dinner stresses you out, then day trading is probably not for you.

Day trading is a strategy where you pay close attention to the stock market all day long, buying and selling shares as the market rises and falls. You can do it yourself at your computer with a brokerage account, or you can use a broker to handle your trades for you. You tell them to buy or sell shares based on how the stock price is doing, hoping that you get it right.

If this sounds like gambling, it is.

You can make a lot of money very quickly by trading stocks and betting on the market. You can also lose a lot quickly, too.

If you want to try this strategy without losing any real money, it’s easy. You can keep track of stock prices using your iPhone or on any stock-tracking website, like https://www.tradingview.com/screener. Here’s how to do it:

- Pick a few companies and pretend you bought 100 shares of each one. Each company has a stock symbol in place of its name, like TSLA for Tesla.

- Check the stock each day, and see how the price rises and falls.

- After a week, pretend you sold all your shares. Calculate how much you would have gained or lost.

That’s a very simple exercise just to show you how it works. If you want to try it at a higher level, you can do some research to find out which stocks might be the best to buy. You can see the history of their share price over days, months, or years. You can also learn what the company does and see if you can figure out how well they might do in the future.

This is what people who invest in the stock market do. It’s not random, it’s a lot of research — but ultimately it’s still a gamble.

Investing for Dividends

The other stock market strategy is not as exciting. In fact, it can be downright dull in comparison. However, it’s much less risky and you always make some money.

Many companies who sell stock also pay out what’s called dividends. When they do well, they reward their shareholders with a bonus. The cool part is that they have to decide every year how much they’re going to pay in dividends. For example, if Verizon (VZ) announces they’re going to pay shareholders .64 cents per share in 2023, they have to stick to it.

No matter how much the stock price rises or falls, you earn a certain amount for every share you own.

In my Verizon example, let’s say I own 21 shares (which I do right now). 21 shares x .64 cents each is $13.44. It’s not a fortune. But if I invest in ten other stocks that also pay high dividends, I can earn a couple hundred dollars a year, depending on how many shares I own of each stock. There’s much more to this strategy, called The Dogs of the Dow, and you can read about it if you want.

The main point is that a long-term investing strategy isn’t rock star cool, but you’ll have a better chance at making money on your investment over time, with much less risk of losing it.

Even if you trade stocks year-to-year, it’s best to invest in companies that have a long track record of success, even if the share price doesn’t increase significantly. Let’s take a look at Coca-Cola over the years:

In 2006, the share price was about $24. Today it’s $60. You can see from the chart that it’s been on a steady increase for the past 17 years. Fun fact: in 1970 the stock price was .19 cents per share. If you bought 100 shares when I was born for $19, it would now be worth $6,000. That’s a long time to hang onto a stock, but the point of the strategy is long-term investing.

One thing to keep in mind here is the rate of inflation. Every year, things cost a little more than they did the year before. For example, things are about 1.5 times more expensive today (2023) than they were in 2006. That’s not to deter you from long-term investing, it’s just something to keep in mind.

Real Estate

When you think of real estate, you might think of houses. That’s one type of real estate, but there are also commercial properties (like a mall or an office building), apartment buildings, and land.

Commercial Property

If you think about the mall, you know that it’s filled with stores and kiosks. All of those stores pay rent to the owner, and that’s how the owner makes money. Simple, right? It’s unlikely that you can afford to buy a mall right now. But there are other ways to buy into commercial property. You can buy shares in a certain type of investment company that puts their money into commercial buildings. You earn a percentage of the profits.

I’m not going to cover this in detail, I just want you to know that it exists.

Apartment Buildings

This is another one you likely can’t afford right now. But in the same way as commercial property, you would earn money by collecting rent on each apartment. If you connect with smart people, you might be able to go in on a building as a group and each earn a portion of the profits from rent. It’s a little more accessible than commercial property, but it’s still a lot to invest.

Houses

This is more like it. Houses are much easier to afford for an individual, and there’s less red tape and maintenance costs than with the other two types I mentioned. Again, it’s simple; you buy a house, rent it to someone, and collect the money.

Besides rent, there are other advantages to being a landlord. You can deduct things related to your rental home from your taxes. And any time you can deduct money from what you pay in taxes, do it. Legally, of course.

It also becomes easier to buy other houses. When you own one house, banks can use your equity in the house to secure a loan on another one. Equity is how much money you’ve paid on your existing mortgage. The more equity you have, the easier it is to get a loan.

A rental property is a great investment because you suddenly have a steady income flowing in every month without doing a lot of work. For example, let’s say you buy a home and have a mortgage that costs you $2000 per month. Your property tax and mortgage insurance are $200 per month. However, let’s say the going rate for the size of home you’re renting in your area is $4000 per month. Some quick math tells us that you’ll be earning $1800 per month. Not to mention that someone else is basically paying your mortgage for you.

Sure, there’s upkeep and emergency repair costs that can come up. But if you put your rental profits into an interest-bearing account, it won’t be stressful if the roof leaks or your tenant’s kid tried to flush a stuffed animal down the toilet.

Summary

The thing is, you should be saving and investing. What happens if you become like Keith Richards and live forever? Better still, wouldn’t it be nice to not have to work so hard just to pay your bills?